Introduction

Watching your teen prepare for college is a rollercoaster of emotions—and paperwork. Just when you think you’ve got it all under control, those college application fees start popping up. It can feel overwhelming, but you’re not alone. This guide breaks down what to expect and how to manage college application costs, so you and your teen can focus on the exciting journey ahead.

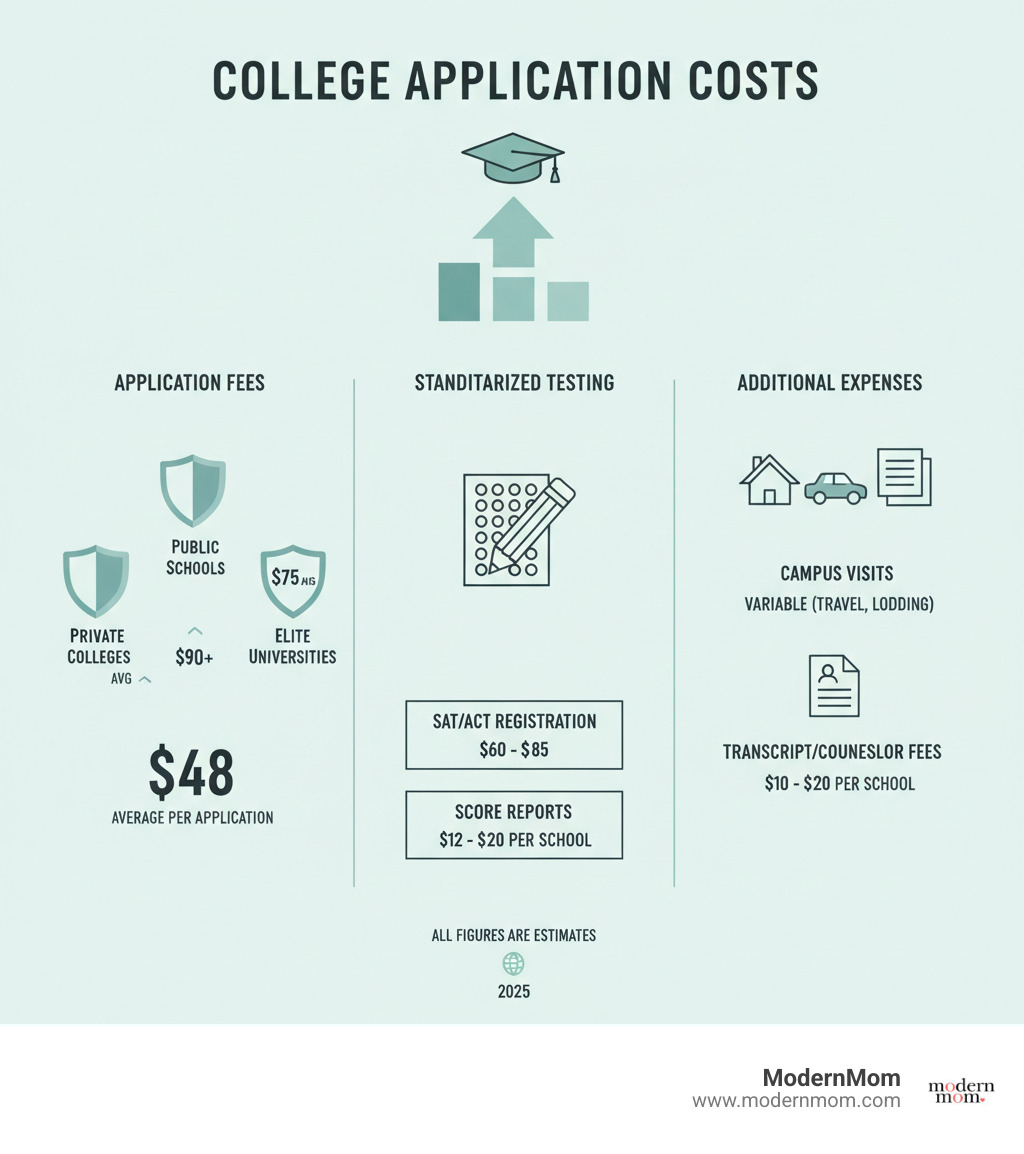

College application fees are one of those sneaky expenses that catch families off guard. Most schools charge between $40 and $90 per application, with some prestigious universities asking for $100 or more. Here’s what you need to know right now:

Quick Facts on College Application Fees:

- Average cost: $48 per application

- Typical range: $30–$90 for most schools

- Higher-end fees: $75–$125 at selective universities

- Total cost example: Applying to 6 schools = roughly $300 in fees alone

- Additional costs: SAT/ACT fees ($65–$68), score reports ($12–$18 per school), AP exams ($98 each), campus visits, and transcript requests

Here’s the reality: if your teen applies to six schools—which is about average—you’re looking at nearly $300 just in application fees. Add in standardized test costs, score reports, and maybe a campus visit or two, and the total can easily climb past $500 before they’ve even been accepted anywhere.

The good news? There are real ways to cut these costs. Fee waivers can eliminate application fees entirely for eligible students. Over 400,000 students received Common App fee waivers in 2022-2023 alone, saving families more than $133 million. Many schools also don’t charge application fees at all—over 500 colleges offer free applications for both domestic and international students.

College application fees can feel overwhelming, but breaking the process down into manageable steps makes all the difference. With the right information, you can plan ahead and find options that work for your family’s budget.

The Lowdown on Application Fees: What They Are and What to Expect

Let’s talk about what you’re actually paying for when you see that college application fee pop up on the screen. It’s basically a one-time processing charge that colleges use to handle your teen’s application. Think of it like the convenience fee you pay when buying concert tickets—not the most exciting expense, but it keeps things running.

So where does your money go? These fees cover the real administrative costs of reviewing thousands of applications. We’re talking about the admissions staff who read every essay and transcript, the technology that keeps application portals running smoothly, and all the behind-the-scenes work that goes into evaluating each student. It takes a lot of people and resources to process tens of thousands of applications each year.

There’s another reason colleges charge these fees: they help filter for serious applicants. When families invest in the application process, it signals genuine interest in attending. Colleges want students who are truly excited about their school, not just clicking “submit” on a whim.

Understanding the Average Cost of College Application Fees

Here’s the reality check: college application fees vary quite a bit, but knowing the landscape helps you plan. The average fee sits around $48, though you’ll see everything from free applications to fees exceeding $100.

Most schools fall into the $30 to $90 range. Public four-year colleges typically charge around $48, while private schools average slightly higher at $54 to $57. If your teen has their heart set on a highly selective university, budget a bit more—the average for Ivy League and similar schools hovers around $80. Harvard asks for $85, and Stanford tops the list at $125 for undergraduate applications. Graduate programs? Those can easily push past $100.

The bottom line: if your teen is applying to six schools at an average of $48 each, you’re looking at roughly $300 just in application fees before adding anything else.

Why Fees Vary From School to School

You might notice one university charges $50 while another wants $100 for basically the same thing. What gives? Each college sets its own fees based on several factors, and understanding why can help you make sense of those price tags.

Highly selective schools that receive tens of thousands of applications often charge more. They need bigger teams and more sophisticated systems to handle the volume and give each application the detailed review they promise. When you’re one of 60,000 applicants, that administrative cost adds up.

On the flip side, some colleges deliberately keep fees low or eliminate them completely. They know that charging a fee might discourage talented students from applying, especially those from families watching every dollar. These schools prioritize building a diverse applicant pool over generating revenue from applications.

The best way to find exact fees? Check each college’s official admissions page or their profile on the Common App. Most schools are upfront about their fees and fee waiver policies right on their websites. No surprises, no hidden costs—just straightforward information to help you plan ahead.

More Than Just the App: Budgeting for Other College Prep Costs

While college application fees usually steal the spotlight, what often catches families by surprise is that those fees are just the beginning. The real costs of applying to college run much deeper than that initial application charge.

Your family will likely face additional expenses that can quickly add up if you’re not prepared. These include standardized test fees, AP exam costs, travel expenses for campus visits, charges for sending transcripts, and even fees for financial aid applications like the CSS Profile. The key to staying sane? Budget for all of it from the start, so nothing catches you off guard.

Factoring in Standardized Test and AP Exam Fees

Standardized tests are still a major part of the college application process for many schools, and they come with their own price tags that deserve attention.

The SAT exam costs $68 to register. Your teen gets four free score reports if they’re requested within nine days of taking the test. After that, each additional score report costs $14—and if your teen is applying to eight or ten schools, those reports add up fast. International students should expect to pay additional fees on top of the base cost.

The ACT exam runs $68 without the writing section, or $93 if your teen adds the essay. Like the SAT, you get four free score reports, but each one after that costs $18.50. If your teen takes either test multiple times to improve their score (which many students do), you’re looking at these fees several times over.

Then there are AP exams. Each one costs $98, and if your teen is taking three or four AP classes, that’s close to $400 just for the tests. While AP exams aren’t technically required for college applications, they’re a smart long-term investment. Earning college credit in high school can save thousands of dollars in tuition later by reducing the number of courses your teen needs to take in college. Just keep in mind that requesting score reports after the deadline can tack on an additional $15 per report.

Managing College Visit and Other Hidden Expenses

College visits are one of those expenses that can sneak up on you. They’re invaluable—nothing beats seeing a campus in person to gauge whether it’s the right fit. But between gas, flights, hotels, and meals, a single college visit can easily cost several hundred dollars. Multiply that by four or five schools, and you’re looking at a serious chunk of change.

The good news? You have options. Virtual tours have come a long way and offer a fantastic, free way to get a first impression of a school. Most colleges now provide excellent online information sessions, virtual campus tours, and even virtual meetings with current students. Use these to narrow down your list before committing to in-person visits.

When you do travel, be strategic. Visit multiple schools in one region to maximize your trip. If you have friends or family near a college, consider staying with them instead of booking a hotel. Some families even carpool with friends who are also on the college tour circuit, splitting gas costs and making the experience more fun.

Beyond travel, watch out for these other expenses. Transcript fees typically run between $5 and $10 each time your teen’s high school sends official transcripts to colleges. Some schools charge even more for rush processing.

And if your teen is applying for institutional financial aid, many colleges require the CSS Profile in addition to the FAFSA. The CSS Profile costs $25 for the first school or scholarship program, then $16 for each additional one. If your teen is applying to six schools that require it, that’s another $105.

The bottom line? College application fees are just one piece of a much larger financial puzzle. By mapping out all these costs early and looking for ways to save—whether through virtual visits, strategic planning, or fee waivers—you can steer this process without the sticker shock.

Smart Strategies for Reducing College Application Fees

Here’s the good news: you don’t have to pay full price for every application. With a little planning and know-how, you can significantly cut down on college application fees and keep more money in your family’s budget.

The key is being strategic from the start. Instead of applying to every school that looks interesting, focus on quality over quantity. A thoughtful approach not only saves money but also saves your teen from application burnout.

Create a Smart College Shortlist

One of the best ways to save on college application fees is to help your teen build a focused, well-researched college list from the beginning. It’s tempting to cast a wide net—after all, more applications might seem like more chances, right? But here’s the reality: students applied to an average of 6.14 colleges in 2024-2025, which translates to nearly $295 in fees alone.

The smarter approach? Do the research upfront. Sit down with your teen and have honest conversations about what they’re really looking for. What kind of campus vibe appeals to them? What size school feels right? Which programs match their interests? What can your family realistically afford?

This research helps them build a balanced list that includes reach schools (those exciting dream schools where admission might be a stretch), match schools (where their credentials fit nicely with admitted students), and safety schools (where they’re very likely to get in). A well-curated list of 5-8 schools that are genuine fits beats applying to 12 random schools any day.

Beyond saving money, a focused list reduces stress for everyone. Your teen can put more effort into each application, writing stronger essays and tailoring their materials to each school. That’s a win-win.

Find Colleges That Don’t Charge Application Fees

Here’s a strategy that’s often overlooked: apply to schools that don’t charge application fees at all. Yes, they really exist—and there are more than you might think!

Over 700 of the top 1,600 four-year colleges have a $0 application fee. More than 170 colleges have chosen to eliminate application fees entirely to attract a more diverse applicant pool. These aren’t just lesser-known schools, either. You’ll find quality institutions across different types:

Community colleges like Houston Community College and Santa Monica College typically don’t charge application fees. Smaller liberal arts colleges such as Cornell College and Webster University offer free applications. All military academies, including the U.S. Naval Academy and the U.S. Military Academy, have no application fees. Schools within the City University of New York (CUNY) system offer free applications, and some states like Colorado even host special “free application periods” for in-state schools during certain times of the year.

Finding these schools is easier than you might think. You can filter for colleges with no application fee in the College Search tab of the Common App, or simply check individual college websites. Many schools proudly advertise their no-fee policy right on their admissions page.

This is one of the simplest ways to save money—and every free application is one less fee to worry about. If your teen applies to even two or three no-fee schools, you’ve already saved over $100.

Opening up Fee Waivers: Your Guide to Applying for Free

Here’s something that might surprise you: even if a college lists an application fee on their website, your teen might not have to pay it. Fee waivers exist specifically to remove financial barriers from the college application process, and they’re more accessible than many families realize.

Think of fee waivers as a safety net designed to ensure that talented students can pursue their educational dreams regardless of their family’s financial situation. They’re not a “handout”—they’re a recognition that college application fees shouldn’t stand between a deserving student and their future.

Who Is Eligible for a Fee Waiver?

The good news is that millions of students qualify for fee waivers each year. Financial need is the primary qualifier, but there are several pathways to eligibility.

Students demonstrating financial need make up the largest group of eligible applicants. This includes teens whose families participate in federal assistance programs like free or reduced-price lunch, SNAP (food stamps), or TANF (cash assistance for families). If your household receives low-income financial aid from the government or meets specific income guidelines set by the College Board or NACAC, your teen likely qualifies.

If your teen already received a fee waiver for the SAT or ACT, that’s essentially a golden ticket. These students automatically qualify for college application fee waivers at most schools. The College Board even provides unlimited score reports for SAT fee waiver recipients, which can save hundreds of dollars when applying to multiple schools.

First-generation college students—those who will be the first in their family to attend college—often qualify for waivers at schools that want to support these trailblazers. Similarly, veterans and active-duty military members frequently receive waivers as a thank-you for their service.

Other circumstances that may qualify your teen include being homeless, living in foster care, or being an orphan. Some colleges even offer waivers for students who attend campus tours or live in the school’s local area—it never hurts to ask!

The specific criteria vary by institution, so checking with each college’s admissions office will give you the clearest picture of what they offer.

How to Get Your College Application Fees Waived

Getting a fee waiver is usually more straightforward than you might think, especially with your teen’s school counselor in your corner.

For Common App users, the process is beautifully simple. Your teen will find a fee waiver statement in the Profile section of their application. If they meet the eligibility criteria—like receiving an SAT/ACT fee waiver or participating in a free lunch program—they simply answer “Yes” and provide their signature. Their school counselor will then confirm their eligibility electronically. The best part? Once approved, this single fee waiver applies to every college your teen applies to through the Common App platform. In 2022-2023 alone, over 400,000 students received Common App fee waivers, saving families more than $133 million in application fees.

NACAC fee waivers work slightly differently. These forms, available on the NACAC website, can be used for up to four colleges. Your teen completes their portion, then a school counselor or authorized official from a community organization verifies the economic eligibility. It’s a straightforward process that opens doors to schools that might not be on the Common App.

Many colleges also have their own institutional fee waiver policies that go beyond what’s offered through the Common App or NACAC. The most direct approach is to contact the admissions office—a simple email or phone call explaining your situation and asking about fee waiver options often yields positive results. Some schools automatically waive fees for students who attend specific recruitment events, college fairs, or online webinars, so keep an eye out for these opportunities when researching schools.

Your teen’s school counselor is truly your secret weapon in this process. Counselors know the ins and outs of fee waiver programs, understand eligibility requirements, and often have direct relationships with college admissions offices. They can help complete necessary forms, verify eligibility, and advocate for your teen. Don’t hesitate to schedule a meeting early in the application process to discuss all available options.

By taking advantage of fee waivers, you’re ensuring that financial constraints don’t limit your teen’s college choices. It’s about opening doors, not closing them because of cost.

Frequently Asked Questions About College Application Costs

Do international students have to pay higher application fees?

It’s a common question, and honestly, the answer isn’t straightforward. Sometimes international students pay the same college application fees as domestic applicants. Other times, colleges charge a bit more for international applications.

The reason? Processing applications from students outside the U.S. can involve extra steps—evaluating foreign transcripts, verifying international credentials, and managing different payment systems. For example, Harvard University charges $85 for undergraduate applicants and $105 for graduate students, regardless of where they’re from. But some schools do have different fee structures.

The best approach is to check each college’s admissions page specifically for international applicant information. You can also reach out to EducationUSA advising centers, which offer free support and guidance to international students navigating the American college application process, including information about costs.

Are college application fees ever refundable?

Here’s the reality: college application fees are almost always non-refundable. Once you submit payment, that money goes toward processing your teen’s application—reading essays, reviewing transcripts, and managing the admissions system. Whether your teen is admitted, denied, or changes their mind, the work has been done, so the fee stays with the college.

That said, there are rare exceptions. If there’s a technical glitch that causes a double payment, you can usually get one refunded. If the college makes an administrative error on their end, they may issue a refund. And in very unusual cases—like if a program is suddenly canceled after your teen applied—the school might return the fee.

If you think you have a valid reason for a refund, check the college’s refund policy on their website or contact the admissions office directly. Just don’t count on getting your money back in most situations.

How many colleges should my teen apply to?

There’s no one-size-fits-all answer here, and that’s actually good news. You don’t need to apply to a dozen schools to have great options. In fact, applicants using the Common App in 2024-2025 applied to an average of just over six colleges.

Most families find that somewhere between six and eight schools hits the sweet spot. This gives your teen a balanced mix of reach schools (where admission is a stretch), match schools (where they fit the typical profile), and safety schools (where they’re very likely to get in)—without breaking the bank or overwhelming everyone with essays and deadlines.

The real goal isn’t quantity. It’s about fit. When your teen applies to schools they’ve genuinely researched and feel excited about, the process becomes more meaningful and less stressful. Plus, a focused list saves significant money on college application fees and all their associated costs—test score reports, transcript fees, and campus visits.

Help your teen create a thoughtful shortlist that reflects their academic goals, personal preferences, and your family’s financial reality. This approach keeps costs manageable and puts the focus where it belongs—on finding the right college for your teen’s future.

You’ve Got This!

Navigating college application fees and all the other costs that come with this journey can feel like a lot. Between tracking deadlines, managing emotions, and yes—keeping an eye on the budget—it’s easy to feel overwhelmed. But here’s the most important thing to remember: you’ve got this, and you’re absolutely not alone.

The most important thing? College application fees and related expenses don’t have to stand in the way of your teen’s dreams. With a little planning and the right information, these costs become just another manageable part of the process. Start by researching schools that align with your teen’s goals and your family’s budget. Look for colleges that offer free applications or generous fee waiver programs. Encourage your teen to build a thoughtful, focused college list rather than casting too wide a net. And don’t hesitate to reach out to school counselors and admissions offices—they’re there to help, and asking questions is always the right move.

Planning ahead for all the expenses—from standardized tests to campus visits—means fewer surprises and more confidence as you move forward. And if your family qualifies for fee waivers, take full advantage of them. There’s no shame in seeking support; these programs exist precisely because college should be accessible to all deserving students, regardless of their financial situation.

ModernMom is here for you through every step of this journey. Whether you’re figuring out financial aid, supporting your teen through application season, or just need a reminder that you’re doing an amazing job, you’ll find support here. For more tips, resources, and encouragement on everything from college planning to navigating the teenage years, check out ModernMom’s education section. Remember, you are capable, and so is your teen. You’re going to get through this together—one application at a time.

The post Freebies & Fees: Navigating College Application Costs Like a Pro appeared first on ModernMom.