Your Stress-Free Path to Paying for College

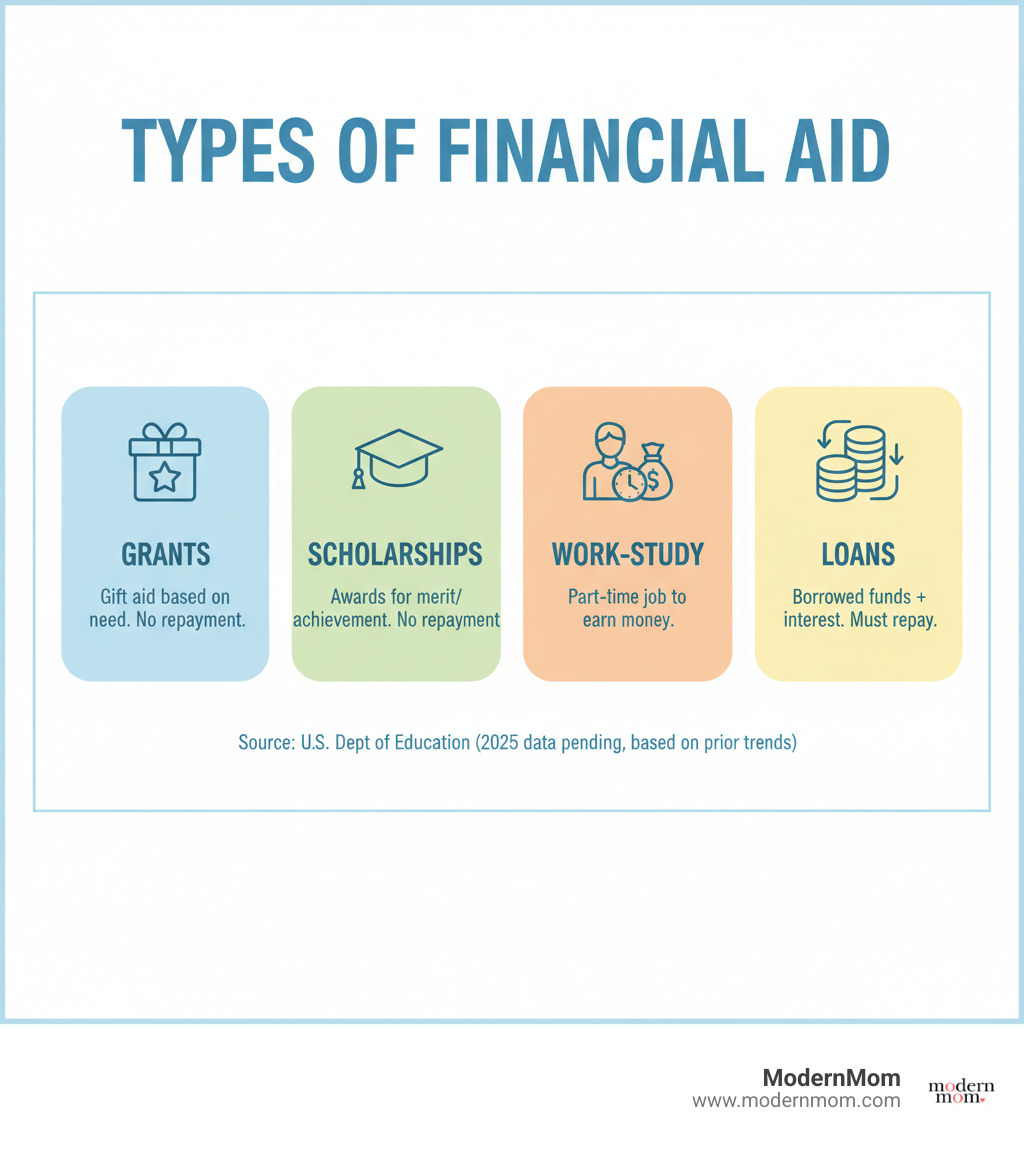

A financial aid guide is your roadmap to the money available for your child’s college education, including grants, scholarships, work-study programs, and loans. Here’s a quick overview:

- Grants are need-based funds that don’t need to be repaid.

- Scholarships reward academic achievement, talents, or other criteria—also free money.

- Work-Study programs let students earn money through part-time jobs.

- Loans are borrowed funds that must be repaid with interest.

Staring at seemingly impossible college tuition bills? You’re not alone. The federal government delivers approximately $112 billion in grant, work-study, and loan funds each year to help families like yours. But navigating the financial aid system can feel overwhelming, especially when you’re already juggling so much.

The good news? You don’t need to be a financial expert. This guide breaks down everything from the Free Application for Federal Student Aid (FAFSA®) to loan repayment in plain language, so you can learn what aid is available, how to apply, and how to maximize every dollar.

We know how stressful college planning can be. This financial aid guide walks you through each step with practical advice you can use right now—no jargon, no confusion.

First Things First: Understanding the Four Main Types of Financial Aid

Before diving into forms and deadlines, let’s clarify what financial aid is. It’s money from the government, schools, or private organizations that helps pay for college costs—not just tuition, but also fees, room and board, books, and supplies.

Financial aid bridges the gap between what college costs and what your family can afford to pay, making higher education possible for millions. If you’re a visual learner, this Overview of the Financial Aid Process video breaks it all down beautifully.

Grants: The “Free Money” You Don’t Pay Back

Grants are the best kind of financial aid: free money you never have to repay. They are typically awarded based on financial need, which is determined by your family’s income and assets.

The most well-known is the Federal Pell Grant, which provides substantial funding to eligible undergraduates. There’s also the Federal Supplemental Educational Opportunity Grant (FSEOG) for students with exceptional need, administered by participating colleges. Many states also offer their own programs, like New York’s TAP Grant or California’s Cal Grant, which can be combined with federal aid.

Grants are game-changers because they directly shrink the amount you owe. With approximately $112 billion in federal aid distributed annually, real money is available for families who need it.

Scholarships: Rewarding Your Child’s Talents

Like grants, scholarships are free money. But they often reward merit—like academic achievements, athletic abilities, artistic talents, or community service—not just financial need. Your child might earn a scholarship from their college, a private foundation, a local business, or even your employer.

The trick is to start searching early and cast a wide net. Websites like Fastweb make it easy to find opportunities that match your child’s unique profile.

Work-Study: Earning While Learning

Federal Work-Study provides part-time jobs for students with financial need, allowing them to earn money for school expenses. These jobs, often on-campus, are designed to work around a student’s class schedule.

Even better, money earned through work-study generally doesn’t count against their financial aid eligibility on the next year’s FAFSA. Work-study is awarded as part of a student’s financial aid package from their school.

Loans: Borrowing for the Future

Loans are borrowed money that must be repaid with interest. While “debt” sounds scary, federal student loans have protections and benefits that make them far more manageable than other types of borrowing.

Loans are a common tool for paying for college. The key is to borrow smartly—only what you truly need—and understand the repayment terms. This helpful video on responsible borrowing is a great conversation starter.

The Ultimate Financial Aid Guide: Conquering the FAFSA®

The Free Application for Federal Student Aid (FAFSA®) is your golden ticket to financial aid. It’s the form colleges use to determine eligibility for federal, state, and institutional aid. Without it, your child could miss out on thousands of dollars. It’s that important!

Curious to learn more? This video explains it wonderfully: What Is FAFSA®?video What Is FAFSA®?video.

Key FAFSA® Updates You Need to Know

Good news! The FAFSA® recently got its biggest makeover in 40 years. The FAFSA Simplification Act makes the form for the 2024-25 and 2026-27 academic years shorter, simpler, and expands aid eligibility for many families.

Here’s what’s new:

- Student Aid Index (SAI): This replaces the Expected Family Contribution (EFC). It’s an index number colleges use to determine how much federal aid your child receives. A negative SAI (as low as -$1,500) indicates very high financial need.

- Direct IRS Data Exchange: All contributors (student, parents, etc.) must now consent to let the IRS directly send tax information to the FAFSA®. This mandatory step streamlines the process and is required to receive federal aid.

- Contributor Role: A “contributor” is anyone required to provide information and consent for the IRS data exchange, usually the student and their parent(s).

- Fewer Questions: The form is much shorter, down from over 100 questions to as few as 46.

- Family Size: The number of family members in college no longer affects federal aid calculations, but schools may still consider it for their own institutional aid.

- Asset Reporting: For the 2024-25 FAFSA, family farms and small businesses must be reported as assets (unless the farm is your primary residence).

For a clear picture of these changes, watch this video: What’s Changed for the 2024–25 FAFSA®Form?video What’s Changed for the 2024–25 FAFSA®Form?video.

Your Step-by-Step FAFSA® Application Checklist

Here’s a simplified checklist to help you and your child prepare:

- Create an FSA ID. Both the student and any parent contributor need a Federal Student Aid (FSA) ID. This acts as your legal signature on StudentAid.gov. Create this before starting the FAFSA® to avoid delays.

- Gather documents. You’ll need Social Security numbers, federal income tax returns from the “prior-prior” year (e.g., 2022 taxes for the 2024-25 FAFSA®), and records of assets like cash, savings, and investments. This video details the information required to complete the FAFSA®.

- Know the deadlines. The federal deadline is generous (June 30, 2025, for the 2024-25 FAFSA®), but state and college deadlines are often much earlier. Apply as soon as the FAFSA® opens to maximize opportunities.

- List all potential schools. You can add up to 20 colleges. Include every school your child is considering, even if they haven’t applied yet.

- Provide consent for IRS Data Exchange. All contributors must approve the transfer of federal tax information from the IRS to be eligible for federal aid.

- Review and submit. Double-check all information before submitting to avoid errors that can cause delays.

Understanding Eligibility and Estimates

To be eligible for federal student aid, your child generally must be a U.S. citizen or eligible noncitizen, have a valid Social Security number, be enrolled in an eligible program, and maintain satisfactory academic progress. Good news: restrictions related to drug convictions and Selective Service registration have been removed.

The Student Aid Index (SAI) is calculated from your FAFSA® information and determines eligibility for federal aid. A lower SAI generally means more financial need and potentially more aid.

For an early estimate of your child’s potential aid, use the Federal Student Aid Estimator. It’s a great way to get a preliminary idea of what to expect.

Navigating the Broader Aid Landscape: From Loans to Repayment

While the FAFSA® is your key to federal aid, it’s just one piece of the puzzle. A comprehensive approach includes state programs, institutional scholarships, and understanding how to manage loans. It’s all part of building a strong financial future, a topic we often discuss at Modern Mom, like in our article on creating financial security for your family.

Federal vs. Private Loans: What’s the Difference?

When grants and scholarships don’t cover the full cost, loans are a common option. But it’s crucial to know the difference between federal and private loans.

| Feature | Federal Student Loans | Private Student Loans |

|---|---|---|

| Source | U.S. Department of Education | Banks, credit unions, state-affiliated organizations |

| Interest Rates | Fixed, generally lower than private loans; set by Congress | Variable or fixed; often higher than federal loans; depends on credit score |

| Credit Check | Generally not required for students (except PLUS Loans); based on financial need | Required; often requires a co-signer, especially for students |

| Repayment Plans | Many flexible options: Standard, Graduated, Extended, Income-Driven Repayment (IDR), Loan Forgiveness | Fewer options; typically standard repayment; deferment/forbearance less generous |

| Borrower Protections | Income-driven repayment, deferment, forbearance, discharge options, loan forgiveness programs, interest subsidies (for Subsidized loans) | Limited or no borrower protections; less flexibility |

| Subsidized/Unsubsidized | Direct Subsidized Loans: Government pays interest while in school and during deferment (need-based). Direct Unsubsidized Loans: Borrower responsible for all interest (not need-based). |

All private loans are unsubsidized; interest accrues from disbursement. |

| Loan Limits | Annual and aggregate limits exist | Limits vary by lender; can be higher than federal limits |

Federal loans almost always offer better terms and protections. The golden rule is to exhaust all federal loan options before considering private loans.

Don’t Forget State, School, and Private Aid

Beyond federal aid, other assistance can help make college more affordable. Many states offer their own State Grant Programs, like New York’s TAP or Excelsior Scholarship. Check your state’s higher education agency website for details.

Colleges are also a fantastic source of Institutional Scholarships & Grants, based on both merit and need. Use the Net Price Calculator on every college’s website to estimate what your family might actually pay after grants and scholarships. And keep encouraging your child to search for Private Scholarships on sites like Fastweb.com.

The College Scorecard is a great tool to compare schools on cost, graduation rates, and student debt.

What to Do for Special Circumstances

If your family’s financial situation changes dramatically after you’ve filed the FAFSA® (e.g., job loss, high medical bills), don’t panic. Colleges can use “professional judgment” to adjust aid offers for these special circumstances.

First, complete the FAFSA® as requested. Then, contact the financial aid office at your child’s college directly. Be ready to explain your situation and provide documentation. This video offers more guidance on Special and Unusual Circumstances.

A Practical Financial Aid Guide to Loan Repayment

Understanding federal student loan repayment options is key to managing debt successfully. Federal loans offer incredible flexibility.

- Income-Driven Repayment (IDR) Plans base monthly payments on income and family size. Payments can be as low as $0, and any remaining balance is forgiven after 20-25 years.

- The new Saving on a Valuable Education (SAVE) Plan is an IDR plan that offers some of the lowest monthly payments. It also prevents balances from growing due to unpaid interest and offers earlier forgiveness for smaller loan balances.

- Public Service Loan Forgiveness (PSLF) forgives the remaining balance on Direct Loans for borrowers who work full-time for a qualifying public service employer and make 120 qualifying payments.

The Loan Simulator on StudentAid.gov can help your child estimate payments under different plans. For a deeper dive, check out this guide to repayment plans.

A Mom’s Guide to Spotting Financial Aid Scams

As you steer this journey, be on the lookout for scams. Here are some major red flags:

- Paying for FAFSA® help: The “F” in FAFSA® stands for FREE. Never pay for help. Official assistance is available at no cost.

- Guaranteed approval or “exclusive” scholarships: No legitimate program can guarantee money before you apply. If it sounds too good to be true, it is.

- Urgent deadlines and high-pressure tactics: Legitimate offers give you time to decide without feeling rushed.

- Requests for personal financial information: Never give out your credit card or bank account details unless you initiated the contact with a reputable source.

- Unsolicited offers: Be skeptical of calls or emails claiming to be from the Department of Education. Always verify with the official StudentAid.gov website. This video offers more tips on protecting yourself from scams.

Frequently Asked Questions About the Financial Aid Process

It’s normal to have questions—every mom does! Here are answers to some of the most common concerns.

I don’t think we’ll qualify for aid. Should we still fill out the FAFSA®?

Yes, absolutely! This is a common myth that costs families money. Even if you don’t qualify for need-based grants, filing the FAFSA® is the only way to access federal student loans, which offer much better terms than private loans.

Many colleges also require a FAFSA® to award their own institutional aid, including merit-based scholarships that aren’t tied to income. Plus, if your financial situation changes unexpectedly, having a FAFSA® on file allows the financial aid office to help. You won’t know what you qualify for until you apply.

My ex and I are divorced. Whose information goes on the FAFSA®?

With the new FAFSA® changes, you’ll use information from the parent who provides the greater financial support to your child. This isn’t about who claims the child on their taxes or where the child lives most of the time—it’s strictly about who contributes more financially.

If that parent is remarried, their spouse’s financial information must also be included. For detailed guidance on this, this video walks through the process: How Do I Complete the 2024–25 FAFSA® Form If My Parents Are Divorced or Separated?video How Do I Complete the 2024–25 FAFSA® Form If My Parents Are Divorced or Separated?video.

Our income has dropped significantly since we filed taxes. What can we do?

If your income has dropped significantly since filing taxes (due to job loss, medical bills, etc.), there’s a path forward. This is what financial aid offices call a special circumstance.

Because the FAFSA® uses older tax information, it may not reflect your current reality. Financial aid offices have the authority to use professional judgment to adjust your child’s aid package. Contact the financial aid office at your child’s college directly, explain the situation, and be prepared to provide documentation (like pay stubs or medical bills). Communication is key when circumstances change.

Conclusion: You’ve Got This, Mom!

Take a deep breath. Navigating financial aid can feel overwhelming, but you’re doing this because you believe in your child’s future, making you the best advocate they have.

This financial aid guide was designed to break down the complexity into manageable steps. You now know the difference between grants and loans, how to tackle the FAFSA®, and where to look for additional aid. You’ve learned that filing the FAFSA® is always worth it and that help is available if your circumstances change.

This is a process. You don’t have to get it perfect on the first try. Financial aid offices are there to help, so don’t hesitate to contact them with questions. Advocating for your family is just being a smart, proactive parent.

You’re not alone in this journey. At Modern Mom, we’re here to support you through every stage of your child’s educational journey.

Ready to explore more? Find more tips on navigating your child’s educational journey and find resources that help you balance it all. You’ve got this, and we’ve got your back.

The post Don’t Break the Bank: Smart Strategies for College Funding appeared first on ModernMom.